In the much-awaited 2024-25 Union Budget, Finance Minister Nirmala Sitharaman brought good news for individual income taxpayers, particularly those in the middle class.

The government has significantly raised the income tax rebate limit from Rs 7 lakh to Rs 12 lakh, a move aimed at providing substantial relief to salaried taxpayers.

This step means that for those earning up to Rs 12.75 lakh, no tax will be levied due to the standard deduction, making it easier for the middle class to save more.

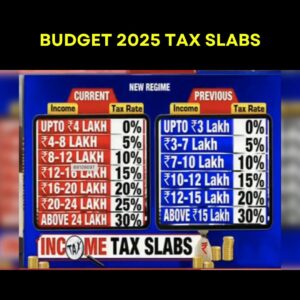

Along with this major announcement, Sitharaman also proposed a rejig of the income tax slabs under the new tax regime, resulting in further tax benefits for individuals.

Key Tax Changes in 2024-25 Budget

- Income Tax Rebate Raised: The rebate limit has been increased to Rs 12 lakh from Rs 7 lakh, benefiting individuals with annual incomes up to Rs 12.75 lakh.

- New Tax Slabs: The tax slabs under the new regime have been restructured, reducing the burden on middle-income groups. This restructuring could lead to substantial savings for taxpayers.

Here’s a look at the new tax brackets and the potential tax savings for various income groups:

New Income Tax Slabs for Budget 2025

| Income Range | Tax Rate |

|---|---|

| Rs 0 – Rs 4,00,000 | Nil |

| Rs 4,00,001 – Rs 8,00,000 | 5% |

| Rs 8,00,001 – Rs 12,00,000 | 10% |

| Rs 12,00,001 – Rs 16,00,000 | 15% |

| Rs 16,00,001 – Rs 20,00,000 | 20% |

| Rs 20,00,001 – Rs 24,00,000 | 25% |

| More than Rs 24 lakh | 30% |

Benefits for Taxpayers

- Rs 12 lakh income: Taxpayers earning Rs 12 lakh will save Rs 80,000, which is 100% of the tax they were paying earlier.

- Rs 18 lakh income: Those earning Rs 18 lakh will save Rs 70,000, which is 30% of their previous tax liability.

- Rs 25 lakh income: Taxpayers earning Rs 25 lakh will save Rs 1.1 lakh, which accounts for 25% of their previous tax outgo.

Sitharaman also announced that the government would present a new Income Tax Bill in Parliament next week. The goal is to simplify the language and rules surrounding income tax, making it easier for both taxpayers and administrators to navigate. This could lead to fewer disputes and a more transparent system.

2025 budget highlights

The new 2025 budget further builds on the foundation laid in previous years with an emphasis on fiscal responsibility, infrastructure growth, and tax simplifications. The government’s commitment to taxpayer welfare continues as tax slabs are adjusted, and rebate limits are refined.

Here’s a detailed look at the new tax projections and allocations:

New Income Tax Slabs for 2025-26 Budget

| Category | 2023-24 Actuals | 2024-25 Budget Estimates | 2024-25 Revised Estimates | 2025-26 Budget Estimates |

|---|---|---|---|---|

| Pension | 238328 | 243296 | 275103 | 276618 |

| Defence | 444699 | 454773 | 456722 | 491732 |

| Subsidy | ||||

| – Fertiliser | 188292 | 164000 | 171299 | 167887 |

| – Food | 211814 | 205250 | 197420 | 203420 |

| – Petroleum | 12240 | 11925 | 14700 | 12100 |

| Agriculture & Allied Activities | 145995 | 151851 | 140859 | 171437 |

| Commerce & Industry | 49809 | 47559 | 56502 | 65553 |

| Development of North East | 1628 | 5900 | 4006 | 5915 |

| Education | 123365 | 125638 | 114054 | 128650 |

| Energy | 52405 | 68769 | 63403 | 81174 |

| External Affairs | 28915 | 22155 | 25277 | 20517 |

| Finance | 23403 | 86339 | 63512 | 62924 |

| Health | 81594 | 89287 | 88032 | 98311 |

| Home Affairs (Incl. UTs) | 196872 | 219643 | 220371 | 233211 |

| Interest | 1063872 | 1162940 | 1137940 | 1276338 |

| IT & Telecom | 82277 | 116342 | 117869 | 95298 |

| Rural Development | 241193 | 265808 | 190675 | 266817 |

| Scientific Departments | 24657 | 32736 | 29831 | 55679 |

| Social Welfare | 42065 | 56501 | 46482 | 60052 |

| Tax Administration | 191327 | 203530 | 207968 | 186632 |

| – GST Compensation Transfer | 145000 | 150000 | 153440 | 130641 |

| Transport | 526765 | 544128 | 541384 | 548649 |

| Urban Development | 68565 | 82577 | 63670 | 96777 |

| Others | 403367 | 473555 | 450008 | 482653 |

| Net Additional Resources | – | -13990 | 39400 | -23000 |

| Grand Total | 4443447 | 4820512 | 4716487 | 5065345 |

Conclusion

This budget is a win for middle-class taxpayers, providing them with much-needed relief and enabling them to retain more of their hard-earned money. The changes to the income tax slabs, along with the rebate limit increase, make the tax structure more progressive and taxpayer-friendly.

These reforms are expected to reduce tax burdens, foster savings, and improve disposable income, which could lead to increased consumption and investment within the economy. With the promise of a simplified tax regime, the government’s effort to improve ease of doing taxes will likely be welcomed by all.

One Response